- Introduction

- Revised Tax Rates for AY 2026-27 (FY 2025-26)

- Individual & HUF

- Rebate under section 87A

- Corporate & Other Entity

- Tax on Foreign Companies

- Investment & Employment Boosters: Key Tax Incentives

- Incentives for IFSC

- Presumptive Taxation for Non-resident companies in electronics manufacturing

- Extension of startup tax benefits

- Simplification & Rationalization Measures

- Charitable Trusts & Institutions

- Business Trusts-Section 115UA

- Harmonization of Significant Economic Presence (SEP) Rules

- Changes in TDS and TCS

- TDS Rate Reduction for Insurance Commission

- Increased TDS/TCS thresholds

- Amendments to Other TDS/TCS Provisions

- Conclusion

Introduction

The Finance Bill 2025-26 introduces significant reforms to India’s direct tax framework, aiming to simplify compliance, promote investment, and drive economic growth. These amendments reflect the government’s broader objective of creating a more efficient, transparent, and growth-oriented tax environment for individuals, businesses, and global investors.

This year’s proposals bring notable changes, including revised tax rates, enhanced deductions, and targeted incentives designed to encourage entrepreneurship, streamline tax administration, and foster a competitive business landscape.

For individuals, corporations, and international stakeholders, understanding these changes are essential for effective financial planning and strategic decision-making.

This article offers a comprehensive analysis of the key provisions of direct taxation, examining their impact on earnings, business profitability, and investment strategies. Let’s explore the critical updates to India’s direct tax structure and what they mean for the financial year ahead.

Revised Tax Rates for Financial Year 2025-26 (Assessment Year 2026-27)

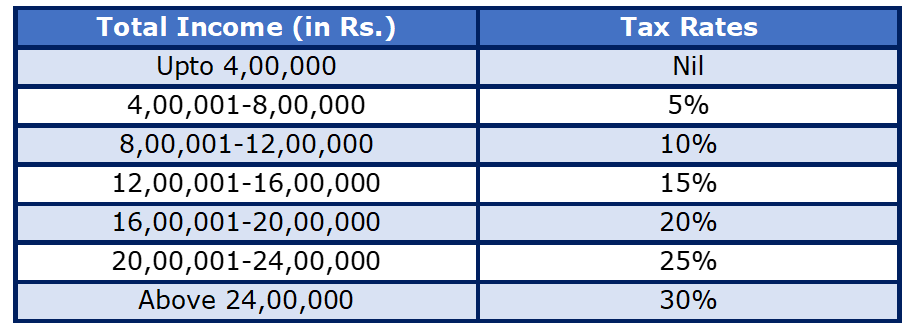

1.1 Individual and HUF

- The revised tax slab under the new tax regime under section 115BAC(1) of the Income Tax Act,1961 is as follows-

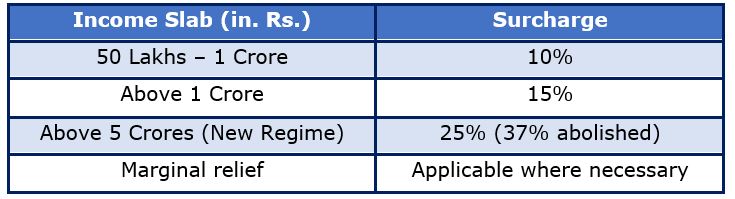

- Surcharge Provisions:

Key Impacts

- The basic exemption limit has been raised from Rs. 3 Lakhs to Rs. 4 Lakhs

- Individuals earning up to Rs. 12 Lakh benefit from an increased Section 87A rebate.

- A progressive structure ensures reduced tax burdens for lower-income groups while keeping the highest tax rate unchanged at 30% for incomes above ₹24 lakh.

1.2 Rebate Under Section 87A

- Rebate limit under section 87A of the Act is increased for individuals opting for the new tax regime:

- Full rebate for income upto Rs. 12 Lakh (previously Rs. 7 Lakh)

- Maximum rebate available is Rs.60,000.

No rebate on capital gains taxable under sections 111A,112 and 112A.

1.3 Corporate and Other Entity

- Domestic Companies with turnover below Rs. 400 crore (in FY 2023-24) will continue to be taxed at 25%, otherwise, they will be taxed at 30%.

- New concessional tax rates remain unchanged under section 115BAA (22%) and section 115BAB (15%) for certain manufacturing companies.

- Surcharge rates remain unchanged: 7% for income exceeding Rs. 1Crore and 12% for income over Rs. 10 Crore.

1.4 Tax on Foreign Companies

- Foreign companies will be taxed at 40%.

- Surcharge remains 2% if total income exceeds Rs. 1 Crore but does not exceed Rs. 10 Crore and 5% for income above Rs. 10 Crore.

Investment & Employment Boosters: Key Tax Incentives

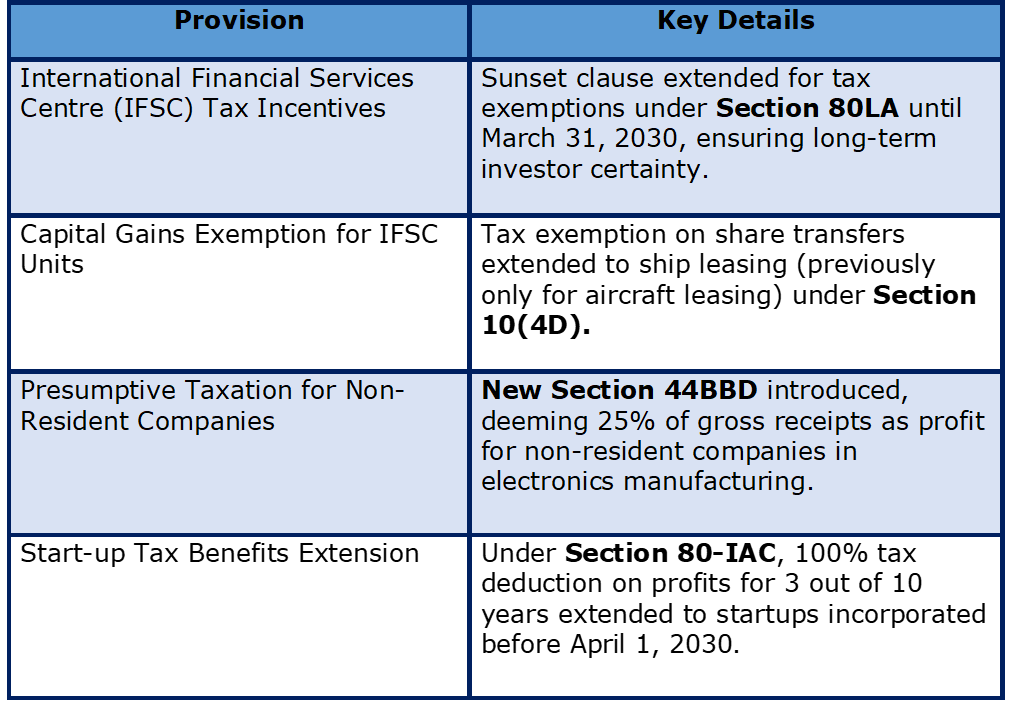

2.1 Incentives for International Financial Services Centre (IFSC)

The Finance Bill 2025-26 provides targeted fiscal measures to enhance the competitiveness of India’s IFSCs. These measures are anchored in amendments to the Income Tax Act, ensuring a stable and attractive investment environment. Key provisions include:

Simplification and Rationalization Measures

3.1 Charitable Trusts & Institutions

The Finance Bill 2025-26 introduces substantial reforms to simplify the regulatory framework governing charitable trusts and institutions. These measures are designed to reduce administrative burdens and foster greater transparency while ensuring that social welfare organizations can focus on their core activities. Key changes include:

The validity of registrations for smaller charitable trusts and institutions has been extended from 5 years to 10 years. This amendment, which

aligns with modifications in Section 12AB of the Income Tax Act, reduces the frequency of renewals and the associated compliance costs.

3.2 Business Trusts – Section 115UA

Business trusts, which include Real Estate Investment Trusts (REITs) and Infrastructure Investment Trusts (InvITs), play a critical role in channeling investments into infrastructure and real estate. The Finance Bill 2025-26 introduces targeted reforms to rationalize the taxation of these entities:

Under Section 115UA, business trusts were originally granted a pass-through status, allowing certain income streams from investments in Special Purpose Vehicles (SPVs) to avoid taxation at the trust level. However, the Finance Bill 2025-26 revises this framework to ensure that business trusts are taxed at the maximum marginal rate on their overall income.

Prior to amendment, Section 115UA(2)of the Act states as follows:

“Subject to the provisions of section 111A and section 112, the total income of a business trust shall be charged to tax at the maximum marginal rate.”

Post amendment, it is proposed to add a reference to Section 112A of the Act ensuring that the income of the business trusts that qualify as capital gains are taxed according to the preferential rates as per Sections 111A, 112, and 112A of the Act.

3.3 Harmonization of Significant Economic Presence (SEP) Rules

The SEP framework was incorporated into Section 9(1)(i) of the Act, which defines when a non-resident has a “business connection” in India and is therefore liable to pay taxes in the country. However, due to the evolving international tax landscape and India’s commitment to global tax reforms under the OECD’s Base Erosion and Profit Shifting (BEPS) framework, the Finance Bill 2025-26 has introduced refinements to the SEP provisions to better align them with global digital taxation rules and bilateral tax treaties.

Key Amendments

- Expanded Scope of SEP Definition

- The Amendment expanded the definition to include businesses that systematically and continuously engage within Indian consumers through digital means, even without a physical presence in India.

- Exemption for Certain Transactions

- The Bill exempts transactions that are solely for the purpose of export from being considered under SEP, ensuring that NR businesses engaged purely in buying goods from India for export are not unnecessarily taxed under SEP.

Changes in TDS and TCS

4.1 TDS Rate Reduction for Insurance Commission

One of the major changes in TDS provisions is the reduction in the TDS rate for insurance commission under Section 194D of the Income Tax Act. Previously, insurance agents faced a TDS deduction of 10% on commission received from insurance companies, creating cash flow challenges for smaller agents and independent financial advisors.

Under the Finance Bill 2025-26, the TDS rate on insurance commission has been reduced from 10% to 5% to provide liquidity relief to insurance agents and promote growth in the insurance sector.

4.2 Increased TDS/TCS Thresholds

| Section | Nature of Payment | Previous TDS Threshold (Rs.) | Revised TDS Threshold (Rs.) |

| 193 | Interest on Securities | NIL | 10,000 |

| 194 | Payment of dividends to Individuals | 5,000 | 10,000 |

| 194 A | Interest other than interest on securities | 50,000 for Senior Citizens | 1,00,000 for Senior Citizens |

| 40,000 in case of others when payer is bank, cooperative society and post office | 50,000 in case of others when payer is bank, cooperative society and post office | ||

| 5,000 in other cases | 10,000 in other cases | ||

| 194B | Winnings from lottery, crossword puzzle Etc. | Aggregate of amounts exceeding 10,000/- during the financial year | 10,000/- in respect of a single transaction |

| 194 BB | Winnings from horse race | ||

| 194D | Insurance commission | 15,000 | 20,000 |

| 194 G | Income by way of commission, prize etc., on lottery tickets | 15,000 | 20,000 |

| 194 H | Commission or brokerage | 15,000 | 20,000 |

| 194-I | Rent | 2,40,000 during the financial year | 50,000 per month or part of a month |

| 194 J | Fee for professional or technical services | 30,000 | 50,000 |

| 194 K | Income in respect of units of a mutual fund or specified company or undertaking | 5,000 | 10,000 |

| 194LA | Income by way of enhanced compensation | 2,50,000 | 5,00,000 |

| 206C(1G) | Remittance under LRS and overseas tour program package | 7,00,000 | 10,00,000 |

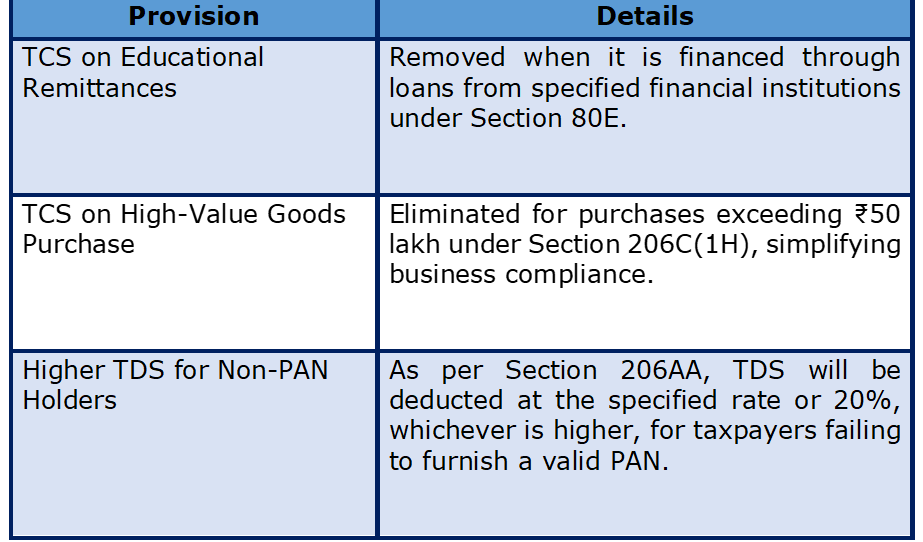

4.3 Amendments to Other TDS/TCS Provisions

Effective from April 1, 2025, several changes to TDS and TCS provisions will come into effect:

Conclusion

The Finance Bill 2025-26 aims to simplify India’s tax system, boost investment, and enhance economic growth. By introducing targeted reforms—such as revised tax rates, extended incentives for startups, and measures to promote international financial services—the government underscores its commitment to simplifying tax compliance and stimulating economic growth.

Notable amendments, including the rationalization of TDS/TCS provisions and refinements to the Significant Economic Presence (SEP) rules, reflect a strategic alignment with global taxation standards. These reforms are designed to ease tax burdens, improve liquidity, and create a fairer tax environment.

Understanding these changes will be crucial for individuals, businesses, and investors to plan strategically and navigate the evolving regulatory landscape in the upcoming fiscal year.